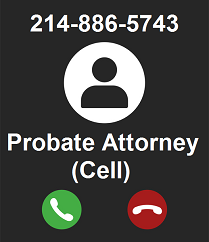

Probate: 469.708.6050

Wills & Guardianship: 214.227.6400

13355 Noel Rd., Ste. 1100

Dallas, Texas 75240

Probate Navigator

Answer: Affidavit of Heirship

You have arrived at this solution because:

- The Decedent died without leaving a Will.

- The Decedent died leaving only motor vehicles, real property, and/or tangible personal property.

These types of assets can be transferred through affidavits of heirship or by delivering possession of the property.

For motor vehicles the heirs of the estate can complete Texas Department of Motor Vehicles Form VTR-262, Affidavit of Heirship for a Motor Vehicle. In order the DMV to accept the form without court involvement, there must be no pending application for administration or probate on file with a court. There also must be no necessity for an administration upon the estate nor for probate of a will. If there is a pending application for probate or there are debts due and owing by the estate, then this could be a problem..

For real estate, two disinterested witnesses can execute an Affidavit of Heirship which is then filed in the county clerk's deed records indicating who inherited the property according to Texas' intestacy laws. An Affidavit of Heirship can be received in an heirship proceeding or in a suit involving title to real property, as prima facie evidence of the facts therein stated, if the affidavit has been of record for five or more years. The gatekeepers in this process are often the mortgage company having a lien against the property, or the title underwriters who are issuing a title policy when the property is being sold. They may accept an Affidavit of Heirship even if such document has not been of record for five years. Sometimes, however, they may insist upon a judgment declaring heirship or the appointment of an administrator. A common problem we see is that if there is a mortgage against the property, the mortgage company may refuse to speak to you because you are not the debtor on the loan (i.e. the decedent) due to financial privacy laws. Thus, you may be forced to ask the court for the appointment of an administrator if you need to know information about the loan (balance, payment amount, etc.) even though by law title to the property passed to the heirs at the moment of the decedent's death.

For tangible personal property, possession of the property can be given to the persons who inherited the property according to Texas' intestacy laws.

For help preparing an Affidavit of Heirship for real estate, learn more: Affidavit of Heirship

Get started: Worksheet for Probate without a Will.

Fees: Collin County | Dallas County | Denton County | Tarrant County

© 2015-2023 Duran Firm, PLLC

All rights reserved.