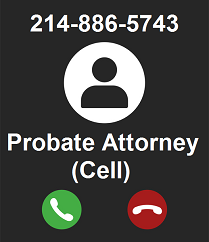

Probate: 469.708.6050

Wills & Guardianship: 214.227.6400

13355 Noel Rd., Ste. 1100

Dallas, Texas 75240

How to Probate a Will in Texas

What is probate? Probate is the legal process that transfers title of property from the estate of the person who has died, known as the "decedent", to his or her beneficiaries. Probate is often sought when the decedent owned real property or financial accounts and the financial institution has requested Letters Testamentary.

How to probate a will? A will is a legal document written to ensure that upon the decedent's death, the decedent's property is given to the people specified in the will. For a will to have any legal effect, it must be "proved-up" or probated in a Probate or County Court to prove it was validly executed, that it is the decedent's last will, and that it has not been revoked. The will and an application asking the court to admit the will to probate are filed with the court. In addition to offering the will for probate, the applicant may also request that the court appoint an executor or administrator for the decedent's estate. This is how you probate a will in Texas."

Who can probate a will? The application may be made by the executor named in the will or by any heir, devisee, spouse, creditor, or any other persons having a property right in, or claim against, the estate.

How long do you have to probate a will in Texas? An application for the probate of a will should be brought within four years after the death of the person making the will. A will can be probated after four years, however, the person bringing the will must explain why he or she should not be held in default for not offering the will in a timely manner. Furthermore, all persons who would inherit in the absence of the will must be notified prior to the court considering the application.

Must the executor use the decedent's attorney that drafted the will? No, there is no requirement that the attorney who drafted the will be the attorney who probates the will. The executor is free to hire the attorney of his or her choice. If the drafting attorney still has possesion of the will and refuses to release it to the executor, the Duran Firm can file a motion with the probate court compelling the executor to surrender the will to the court.

Step 1:

Select the Type of Administration

Probate of a Will as a Muniment of Title Only

Court-Created Independent Administration

Dependent Administration (Fixed Fee Never Available)

Probate of Will as a Muniment of Title Only

(No Administration)

When used - This type of probate is used to admit a will to probate so as to give it legal effect. This type of proceeding is often used when the decedent left a will and the only assets in the estate are the decedent's home or a very small bank account.

Requirements - In order for the court to issue an Order Admitting Will to Probate as a Muniment of Title Only, the following requirements must be met:

- The decedent must have left a valid will;

- There must be no debts due and owing by the estate (or the only debts that are owed are secured by liens on real estate); and

- There must be no need for a formal administration.

How to probate a will as a muniment of title - The original Will and an Application for Probate of Will as a Muniment of Title Only are filed with the Court. If approved, the court will issue on Order Admitting Will to Probate as a Muniment of Title Only.

Administration- There is no administration with this type of probate. The court does not appoint an executor or administrator in this type of proceeding because no administration is necessary. The court's Order Admitting Will to Probate as a Muniment of Title Only constitutes sufficient legal authority to all persons to pay or transfer estate property to the person or persons described in the will as the beneficiary of the property. Some financial institutions, however, may insist on only releasing estate funds to a court-appointed executor or administrator. The institutions do this by insisting that they receive "Letters Testamentary" or "Letters of Administration" prior to releasing estate funds. These "Letters" are the documents issued by the court to the court-appointed executor or administrator. If your loved one had securities or significant bank accounts, you may be forced to ask the court for an administration. Therefore, you should check with the decedent's financial institutions before selecting this type of probate proceeding.

Read more about Muniment of Title vs. Letters Testatamentary

Fees for this type of probate:

Collin County | Dallas County | Denton County | Tarrant County

Independent Administration

(Unsupervised Administration).

When used - This type of probate is used to admit the will to probate so as to give it legal effect and to appoint an executor to administer the estate. This type of proceeding is the most common type of probate where the decedent left a will.

Requirements - In order for the court to issue an Order Admitting Will to Probate and Authorizing Letters Testamentary, the following requirements must be met:

- The decedent must have left a valid will;

- There must be a need for a formal administration; and

- The will must provide for independent administration by appointing a person to serve as "Independent Executor" or by providing that "no other action shall be had in the court in relation to the settlement of the estate than the probating and recording of the will, and the return of an inventory, appraisement, and list of claims of the estate."

How to probate a will and receive Letters Testamentary - The original will and an Application to Probate Will and for Letters Testamentary are filed with the Court. If approved, the court will issue an Order Admitting Will to Probate and Authorizing Letters Testamentary.

Administration- There is an administration with this type of probate. The court appoints an executor and issues Letters Testamentary to the executor. The executor will then be charged with collecting the assets of the estate, paying the debts of the estate, and distributing the remaining assets to the heirs of the estate in accordance with the terms of the will. In an independent administration, the executor of the estate acts independently from the court. That is, the executor does not need the court's permission to pay bills or to sell or distribute the assets of the estate. The executor need only admit the will to probate, notify the beneficiaries of the will of his or her appointment, publish a notice to creditors in the local paper, and file an inventory of the estate's assets with the court.

Fees for this type of probate:

Collin County | Dallas County | Denton County | Tarrant County

Court Created Independent Administration

(Unsupervised Administration).

When used - This type of probate is used to admit the will to probate so as to give it legal effect and to appoint an administrator to administer the estate. This type of proceeding is used when the decedent left a will but no executor is named in the decedent's will, or in situations where each executor named in the will is: 1) deceased; 2) disqualified to serve as executor; 3) unable or unwilling to serve as executor; or 4) is not granted independent status. In this situation, all of the distributees of the decedent must agree on the advisability of having an independent administration and must agree on the person to serve as independent administrator.

Requirements - In order for the court to issue an Order Admitting Will to Probate and Authorizing Letters of Administration, the following requirements must be met:

- The decedent must have left a valid will;

- There must be a need for a formal administration;

- All of the distributees of the decedent must agree on the advisability of having an independent administration and collectively designate in the application for probate, a qualified person to serve as independent administrator; and

- The Court must find that it is in the best interest of the estate to grant an independent administration.

How to probate a will pursuant to a court-created independent administration - The original will and an Application to Probate Will and for Letters of Administration Pursuant to Section 401 of the Texas Estates Code are filed with the Court. If approved, the court will issue on Order Admitting Will to Probate and Authorizing Letters of Independent Administration.

Administration- There is an administration with this type of probate. The court appoints an executor and issues Letters Testamentary to the executor. The executor will then be charged with collecting the assets of the estate, paying the debts of the estate, and distributing the remaining assets to the distributees of the estate in accordance with the terms of the will. In an independent administration, the executor of the estate acts independently from the court. That is, the executor does not need the court's permission to pay bills or to sell or distribute the assets of the estate. After the hearing, the executor need only admit the will to probate, publish a notice to creditors in the local paper, and file an inventory of the estate's assets with the court.

Fees for this type of probate:

Collin County | Dallas County | Denton County | Tarrant County

Dependent Administration (Fixed Fees Never Available)

(Supervised Administration).

When used - This type of probate is used to admit the will to probate so as to give it legal effect and to appoint an administrator. This type of proceeding is used when the decedent left a will but no executor is named in the decedent's Will, or in situations where each executor named in the will is: 1) deceased; 2) disqualified to serve as executor; 3) unable or unwilling to serve as executor; or 4) is not granted independent status. In this situation, all of the distributees of the decedent cannot or will not agree on the advisability of having an independent administration or the choice of administrator. This is often the case when the beneficiaries are hostile towards one another.

Requirements - In order for the court to issue an Order Admitting Will to Probate and Authorizing Letters of Administration, the following requirements must be met:

- The decedent must have left a valid will; and

- There must be a need for a formal administration.

How to probate a will pursuant a dependent administration - The original will and an Application to Probate Will and for Letters of Administration are filed with the Court. If approved, the court will issue on Order Admitting Will to Probate and Authorizing Letters of Administration.

Administration- There is an administration with this type of probate. The court appoints an administrator and issues Letters of Administration to the administrator. The Administrator will then be charged with collecting the assets of the estate, paying the debts of the estate, and distributing the remaining assets to the distributees of the estate in accordance with the terms of the Will. In a Dependent Administration, the court closely supervises the administration of the estate. Bills cannot be paid and assets cannot be sold or distributed without the approval of the court. Periodic accountings must also be prepared to advise the court of the status of the estate. The amount of attorney time in this type of proceeding is generally a function of the number of creditors of the estate, the amount and character of the assets in the estate, and the amount of contention amongst the distributees. Effective June 9, 2023, The Duran Firm's hourly rate for attorney's fees is $400 per hour. The Duran Firm's hourly rate for paralegal work is $100 per hour. Therefore, we advise this as a last resort and encourage families to settle their differences before pursuing this type of administration.

Step 2:

Print and Complete

Prospective Client Information Worksheet

To start on your case, the executor named in the will should download the Prospective Client Information Worksheet for Probate of Will by clicking on the link below:

Worksheet for Probate of a Will

BE SURE TO SAVE AND PRINT YOUR WORKSHEET

BEFORE ATTEMPTING TO SEND IT TO THE DURAN FIRM.

The Worksheet is a downloadable Adobe® PDF file. If you are having trouble downloading the file, you may have to install the Adobe® Reader®:

Step 3:

Mail the Completed Prospective Client Information Worksheet and

COPY of the Will to the Firm

Once the named executor has fully completed the Client Information Worksheet, he or she should send the completed Worksheet and a COPY of the decedent's will to:

The Duran Firm

13355 Noel Rd., Ste. 1100, LB20A

Dallas, Texas 75240

NEVER SEND THE ORIGINAL WILL THROUGH THE MAIL.

You may also fax or e-mail the documents to the firm. To avoid junk faxes and spam, we have not listed our fax or email address anywhere on this website. Please call us for the fax number or email address.

A representative from the Firm will contact you upon receiving the Worksheet and the will to discuss payment and to coordinate the delivery of the original will and the signing of the Attorney-Client Fee Agreement and the Application for Probate. If the case will be heard outside of Dallas County, we can make arrangements to meet you at the County Courthouse where the case will be filed. This saves you an unnecessary trip to Dallas County. If you do not hear from the Firm within 1 week of mailing, please call to follow up.

Payment Terms. The Firm accepts cash, checks, money orders, MasterCard and Visa for the payment of attorney's fees and expenses. Due to the reasonableness of our rates, payment of all expected fees and expenses is due prior to the Firm accepting you as a Client.