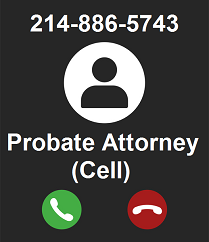

Probate: 469.708.6050

Wills & Guardianship: 214.227.6400

13355 Noel Rd., Ste. 1100

Dallas, Texas 75240

Probate without a Will

What is probate? Probate is the legal process that transfers title of property from the estate of the person who has died, known as the "decedent", to his or her beneficiaries. Probate is often sought when the decedent owned real property or financial accounts and the financial institution has requested Letters Testamentary.

Who can initiate probate proceedings? The application may be made by any heir, devisee, spouse, creditor, or any other persons having a property right in, or claim against, the estate.

What is the time limit for starting probate? If you would like the court to appoint an administrator of the estate, that application must generally be brought within four years after the death of the decedent. The court will often ignore this rule if there is property due to the estate that needs to be collected by an administrator. Other types of probate can be brought at any time.

What happens when a person dies without a will? All is not lost if your loved one dies "intestate"(without a will). Texas has default inheritance rules in place for such an occurrence. See Texas Estates Code Chapter 201. Therefore, if there is no will, or the decedent's will is found to be invalid, the decedent's heirs can still be determined and the decedent's estate can still be probated.

Graphical General Description of Texas Descent and Distribution

Prior to September 1, 1993

Graphical General Description of Texas Descent and Distribution

on or After September 1, 1993

Therefore, if there is no will, or the decedent's will is found to be invalid, the decedent's heirs can still be determined and the decedent's estate can still be probated.

Four Quick Steps to Probating an Intestate Estate

- Select the Type of Administration

- Print and Complete Prospective Client Information Worksheet

- Mail the Completed Prospective Client Information Worksheet to the Firm

- Make Payment

Step 1: Select the Type of Administration

Affidavit of Heirship (No Administration)

When used — This type of affidavit is used to establish title to real estate where the sole asset of the estate is real property.

Requirements — In order to file an affidavit of heirship, the following requirements must be met:

- The decedent must have died without a will;

- No petition for the appointment of a personal representative may be pending or have been granted; and

- No formal administration is necessary.

Procedure — An affidavit of heirship is prepared that details the decedent's heirship facts and the assets of the estate. The affidavit is then signed before a notary public by two disinterested witnesses. The affidavit is then filed in the real property records on file with the county clerk’s office.

Administration — There is no administration associated with this type of probate. Affidavits of heirship are filed with the county clerk, not the court.

Fees for this type of Probate: Collin County | Dallas County | Denton County | Tarrant County

Small Estate Affidavit (No Administration with Court Approval)

When used — This type of affidavit is used to collect a small amount of money owed to the estate (such as a small bank account). A small estate affidavit may also be used to transfer title to real property that still qualifies as a homestead upon the death of the decedent.

Requirements — In order for the court to approve such an affidavit, the following requirements must be met:

- The decedent must have died without a will;

- The assets of the estate, exclusive of homestead and exempt property, must exceed the known liabilities of said estate, exclusive of liabilities secured by homestead and exempt property;

- No petition for the appointment of a personal representative may be pending or have been granted;

- Thirty days must have elapsed since the death of the decedent; and

- The value of the entire assets of the estate, not including homestead and exempt property, must not exceed $75,000.

Procedure — A small estate affidavit is prepared that details the decedent's heirship facts and the assets of the estate. The affidavit is then signed before a notary public by all of the heirs of the estate and two disinterested witnesses. The affidavit is then filed with the court which either approves or denies the affidavit. If approved, the Court will issue an Order Approving Small Estate Affidavit. The Order constitutes authority for the bank to transfer the money to the distributees named in the affidavit.

Administration — There is no administration associated with this type of probate. The court does not appoint an administrator in this type of proceeding because no formal administration is necessary. Some financial institutions, however, may insist on only releasing estate funds to a court-appointed executor or administrator. The institutions do this by insisting that they receive "Letters Testamentary" or “Letters of Administration” prior to releasing estate funds. These “Letters” are the documents issued by the court to the court-appointed executor or administrator. If your loved one had securities or significant bank accounts, you may be forced to ask the court for an administration. You should check with the decedent’s financial institutions before selecting this type of probate proceeding.

Fees for this type of Probate: Collin County | Dallas County | Denton County | Tarrant County

Determination of Heirship (No Administration with Court Judgment)

When used — This type of probate is used to establish title to estate property where the assets include real and/or personal property and the estate does not qualify for a small estate affidavit. This type of probate is also used when the all of the heirs of the estate cannot or will not sign a small estate affidavit.

Requirements — In order for the court to issue a Judgment Declaring Heirship, the following requirements must be met:

- The decedent must have died without a will or when there was a will but any real or personal property was omitted from such will;

- There are no debts due and owing by the estate; and

- There is no need for a formal administration to pay bills or collect and distribute estate property.

Procedure — An Application for Determination of Heirship is filed with the court. The court then appoints an attorney ad litem for unknown heirs who will investigate the heirship facts of the decedent. After a hearing, the court will issue a Judgment Declaring Heirship which names the heirs of the estate. The Judgment Declaring Heirship can then be used to prove title to estate property.

Administration — There is no administration associated with this type of probate. The court does not appoint an administrator in this type of proceeding because there is no need for a formal administration. The court merely declares the identity of the heirs of the estate. Please know that some financial institutions insist on only releasing estate funds to a court-appointed executor or administrator. The institutions do this by insisting that they receive “Letters Testamentary” or “Letters of Administration” prior to releasing estate funds. These “Letters” are the documents issued by the court to the court-appointed executor or administrator. If the decedent had securities or significant bank accounts, you may be forced to ask the court for an administration. You should check with the decedent’s financial institutions before selecting this type of probate proceeding.

Fees for this type of Probate: Collin County | Dallas County | Denton County | Tarrant County

Court Created Independent Administration (Unsupervised Administration)

When used — This type of probate is used when there is a necessity for an administration and all of the heirs of the estate agree to an independent administration and the person to serve as administrator.

Requirements — In order for the court to create an independent administration, the following requirements must be met:

- The Decedent’s date of death must have been within the last four years;

- The decedent must have died without a will or the will must have failed to distribute all of the decedent's property;

- There must be a need for a formal administration;

- All of the heirs of the estate agree on the agree on the advisability of having an independent administration;

- All of the heirs of the estate agree on a qualified person, firm, or corporation that will serve as independent administrator;

- The court must find that an independent administration is in the best interest of the estate (note: the court will usually not grant an independent administration if a minor child is an heir to the estate).

Procedure — An Application for Letters of Administration Pursuant to Section 401 of the Texas Estates Code is filed with the court. All of the heirs of the estate must either sign on to the Application or sign a consent form. The court then appoints an attorney ad litem for unknown heirs who will investigate the heirship facts of the decedent. After a hearing, the court will issue a Judgment Declaring Heirship which names the heirs of the estate. The court will also determine if there is a need for an administration and whether an independent administration is in the best interest of the estate. If so, the Court will appoint an Independent Administrator of the Estate and issue Letters of Administration to the Administrator.

Administration — There is an administration associated with this type of probate. The court appoints an administrator and issues Letters of Administration to the administrator. The administrator will then be charged with collecting the assets of the estate, paying the debts of the estate, and distributing the remaining assets to the intestate heirs of the estate in accordance with the Judgment Declaring Heirship. In an independent administration, the administrator of the estate acts independently from the court. That is, the administrator does not need the court’s permission to pay bills or to sell or distribute the assets of the estate to the intestate heirs. After the hearing, the administrator need only publish a notice to creditors in the local paper, and file an inventory of the estate’s assets with the court.

Fees for this type of Probate: Collin County | Dallas County | Denton County | Tarrant County

Dependent Administration (Supervised Administration)

When used — There is a necessity for an administration and all of the heirs of the estate will not or cannot agree to an independent administration or the person to serve as administrator. This is frequently the case when the beneficiaries are hostile towards one another or when one of the beneficiaries is a minor.

Requirements — In order for the court to create an independent administration, the following requirements must be met:

- The Decedent’s date of death must have been within the last four years;

- The decedent must have died without a will or the will must have failed to distribute all of the decedent’s property; and

- There must be a need for a formal administration.

Procedure — An Application for Letters of Administration is filed with the court. At the hearing, the court will determine if there is a need for an administration. If so, the Court will appoint an Administrator of the Estate and issue Letters of Administration to the Administrator.

Administration — There is an administration associated with this type of probate. The administrator will be charged with collecting the assets of the estate, paying the debts of the estate, and distributing the remaining assets to the heirs of the estate in accordance with the default inheritance rules. The court closely supervises the administration of the estate. Bills cannot be paid and assets cannot be sold or distributed without the approval of the court. Periodic accountings must also be prepared to advise the court of the status of the estate. The amount of attorney time in this type of proceeding is generally a function of the number of creditors of the estate, the amount and character of the assets in the estate, and the degree of disharmony amongst the heirs.

Step 2: Print and Complete Prospective Client Information Worksheet

To get a quick start on your case, an heir to the estate (preferably the chosen Administrator, if any) should download the Prospective Client Information Worksheet for Probate without a Will by clicking on the link below:

Worksheet for Probate without a Will

BE SURE TO SAVE AND PRINT YOUR WORKSHEET

BEFORE ATTEMPTING TO SEND IT TO THE DURAN FIRM.

The Worksheet is a downloadable Adobe® PDF file. If you are having trouble downloading the file, you may have to install the Adobe® Reader®.

Step 3: Mail the Completed Prospective Client Information Worksheet to the Firm

Once the heir has fully completed the Client Information Worksheet, he or she should send the completed Worksheet to:

The Duran Firm

13355 Noel Rd., Ste. 1100, LB20A

Dallas, Texas 75240

A representative from the Firm will contact you upon receiving the worksheet to discuss payment and to coordinate the signing of any Affidavits or Applications. If you do not hear from the Firm within 1 week of mailing, please call to follow up.

Step 4: Make Payment

Payment Terms — The Firm accepts cash, checks, money orders, MasterCard and Visa for the payment of attorney’s fees and expenses. Due to the reasonableness of our rates, payment of all expected fees and expenses is due prior to the Firm accepting you as a Client.

How much does probate cost? — At the Duran Firm we always provide the Client with a written contract that spells out all of the expected attorney's fees and expenses. For an idea on what you can expet to pay, please go on to the next page:

Fees for Probate without a Will

© 2006-2021 Duran Firm, PLLC

All rights reserved.