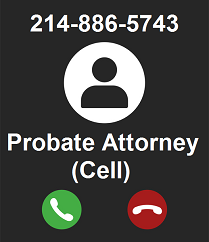

Probate: 469.708.6050

Wills & Guardianship: 214.227.6400

13355 Noel Rd., Ste. 1100

Dallas, Texas 75240

Willing Good: Goal-Driven Estate Planning

If you are researching drafting a will or estate plan, then you are probably a responsible, goal-driven person. Your Will, as part of a comprehensive estate plan, is your last chance to do something good for your family. Hence the term, "Willing Good." A person should have a Will that eliminates any questions as to who should inherit and control the estate after death. What if, however, you could go beyond that and draft a Will that helps you or your heirs achieve goals after you are gone? That's what goal-driven planning is about.

Menu

What's included in the Duran Firm Estate Planning Package?

Three Quick Steps to Planning Your Estate

Goal-Driven Planning

Your Will is your last opportunity to accomplish your goals for your family and estate. Whether you want to promote self-sufficiency, encourage education or entrepreneurship, or simply provide a basic level of support, your estate plan should be driven by your goals.

All wills drafted by the Duran Firm have the following features which address the near-universal goals of our clients:

| Independent Administration |

Allows for the quick and efficient administration of your estate by allowing your estate to be probated and administered with the absolute minimum of court involvement required under Texas law. |

|---|---|

| Alternate Distribution Plans |

The Will provides for alternate plans if one or more of the designated primary beneficiaries dies before the Testator, thus eliminating the need to constantly revise the Will. |

| Trusts for Minors |

The Will provides for a trust in case a child becomes an heir to the estate, thus eliminating a costly court-supervised guardianship of that minor's estate. |

| No Contest Clauses |

Provides for the disinheritance of any would-be beneficiary who challenges the estate plan in bad faith. |

| Formal Will Execution Ceremony |

The attorney leads the testator and witnesses through the execution of the Will using a script created by a Texas wills and estates professor. This process makes it difficult to successfully challenge the Will. |

| Self-Proving Affidavits |

As the Will is executed, the testator and witnesses all testify about the process of signing of the Will. This provides evidence to the court that the Will was executed in accordance with Texas law, thus eliminating the need of finding a witness when submitting the Will to the probate court. |

What other goals do you want to accomplish?

Maximum simplicity for heirs. Some of our older clients have successfully raised responsible adults. They are not worried about spendthrift or laziness issues. For these clients, their sole goal is to get their estate to their kids in as quick a manner as possible while minimizing taxes and expenses of administration.

Protection against divorce. There are two circumstances where a bad divorce might result in your estate going to a non-family member. First, the surviving spouse may want to remarry after the death of the first spouse. Second, an heir's current or future spouse may be the problem. Often times an inheritance, though separate property, ends up being placed into a joint account and becomes hopelessly commingled in the event of a divorce. Alternatively, your heir may support the bad spouse with your inheritance. Placing the surviving spouse's or heir's inheritance into a trust can protect it from these bad situations.

Protection from creditors Property left directly to an heir is available to creditors in the event of a judgment. Placing the property in a trust can protect it from seizure.

Encourage entrepreneurship. Property left to an heir can be made available to the heir for the purpose of starting a business. The trustee can require that the heir have some familiarity with the business into which the heir wants to invest.

Encourage academic performance. An incentive trust can provide for the payment of tuition and for extracurricular activities provided that the heir maintains a pre-determined GPA.

Encourage hard work. Would you leave your son an inheritance if you knew it would lead to a couch-potato life of video games and non-stop television? Probably not. A possible solution is to place the inheritance into a trust that matches distributions to earned income. The trust could provide comfort while maintaining an incentive to work.

Discourage substance abuse. There are some situations, like substance abuse, where an inheritance could lead to the death of the beneficiary. Allowing the Trustee to withhold distributions when the beneficiary is addicted can prevent your gift from being used to purchase drugs.

At the Duran Firm we have an initial meeting to discuss your goals for your estate. We will discuss possible solutions and the pros and cons to each option. Once you settle on a plan, we then draft the documents needed to will your good.

What's included in the Duran Firm Estate Planning Package?

The Duran Firm estate planning package includes a comprehensive set of estate planning documents, including documents that will help your heirs avoid probate when possible.

- Simple Will for Non-Taxable Estate

- Transfer on Death Deed (to avoid probate)

- Living Will (Directive to Physicians)

- Statutory Durable Power of Attorney (Financial Power of Attorney)

- Medical Power of Attorney

- HIPAA Authorization (for the release of medical information)

- Declaration of Guardian

- Appointment of Agent for Disposition of Remains

- Medical Power of Attorney for Children

- HIPAA Authorization for Children

- Declaration of Guardian for Children

- Estate Planning Binder

Three Quick Steps to Planning Your Estate

Step 1: Complete and submit Client Information Worksheet online

Step 2: Have initial meeting or teleconference to discuss your post-death goals

Step 3: Discuss and execute final documents

Step 1: Complete Prospective Client Information Worksheet Online

To get started on your estate planning, please complete a Prospective Client Information Worksheet by clicking on one of the links below:

The Worksheets are completed through the firm's secure, online application that allows users to complete forms, sign, and submit to the Duran Firm without having to download, print, scan, fax, etc. The connection is secure and the file that is sent to the Duran Firm is encrypted. Someone from the Firm will contact you upon receiving the Worksheet to coordinate the initial meeting or teleconference. Nevertheless, we do not mind a phone call to let us know you sent it in.

Step 2: Have initial meeting or teleconference to discuss your goals

Once we receive your Client Information Worksheet, you will have a teleconference or in-person meeting with the attorney (your choice) to discuss your final goals. The attorney will discuss options for achieving your goals and help you develop an overall plan.

Step 3: Discuss and execute final documents

After our initial conference, the attorney will draft your documents and send them to you for final review. Once you are satisfied with the documents, we will invite you in for formal execution ceremony. The firm will scan a copy of the executed documents into our system and give the originals to you to take home. While that is being done, the attorney will discuss strategies on how to make probate easy on your heirs including how to avoid probate entirely.

Fees

A lawyer's time is his or her product, which is why many attorneys bill on an hourly basis. The Duran Firm can complete your plan for a fixed fee if all of your estate planning goals can be met as described above. Our fixed fee for this service is $1,000 for an individual and $1,500 for a married or unmarried couple.

If your estate requires tax planning because it is over $13 million, or if you want to place additional restrictions on your estate in order to accomplish other goals, then there will be an additional fee based upon the amount of time it takes to draft the provisions necessary to accomplish your goals. The attorney will advise you of the fees at our initial meeting.

Effective January 1, 2025, The Duran Firm's hourly rate for attorney's fees is $450 per hour. The Duran Firm's hourly rate for paralegal work is $150 per hour.

How to Pay

The Firm accepts cash, checks, money orders, MasterCard and Visa for the payment of attorney's fees and expenses. For credit cards, the firm will send you a payment link. Payment of all expected fees is due prior to the Firm accepting you as a Client.