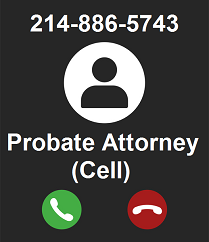

Probate: 469.708.6050

Wills & Guardianship: 214.227.6400

13355 Noel Rd., Ste. 1100

Dallas, Texas 75240

What happens if you die without a Will

The Texas Estates Code provides default rules for persons who die without a Will ("intestate"). The default rules are based upon marital and family relationships and are graphically summarized as follows:

Graphical General Description of Texas Descent and Distribution on or After September 1, 1993

As you may have already determined, there is a significant potential for problems with the intestate distribution scheme. A few of the more typical problems are explained below.

Separate Real Property and the Surviving Spouse - In cases where the Decedent leaves behind a surviving spouse and an estate that includes separate real property, the surviving spouse is often shocked to learn that he or she does not inherit the whole of the separate property. In fact, in cases where the Decedent leaves descendants, the surviving spouse inherits only a "life estate in one-third" in the separate real property. This means that the surviving spouse can live on the property for the remainder of his or her own life, but he or she cannot sell or mortgage the property without the cooperation of the descendants. If those descendants are minors, they may not be able to give legal consent.

Minors or incapacitated persons as heirs of the Estate - Many courts will require that a guardianship be established in order to receive that portion of the estate that is passed to heirs who are incapacitated or who are minors. Furthermore, many Courts will not allow an independent administration in cases where incapacitated persons are heirs of the estate. Thus, in cases where the Decedent leaves behind descendants who are incapacitated, significant court involvement in the estate may be required. Significant court involvement usually means significant attorney's fees.

Community Property and Children from a Previous Relationship - In cases where the Decedent leaves behind descendants from a previous relationship and an estate that includes community property, the Decedent's 1/2 share of the community property estate passes to the Decedent's children, not the spouse. Thus, the surviving spouse will now share the community property estate with the Decedent's children. Again, this means that the surviving spouse cannot sell or mortgage the community property without the cooperation of the other heirs to the property.