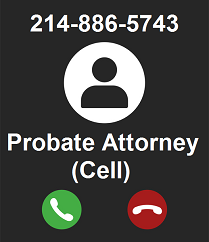

Probate: 469.708.6050

Wills & Guardianship: 214.227.6400

13355 Noel Rd., Ste. 1100

Dallas, Texas 75240

Advantages of Having a Will

A Will is a legal document that is written to ensure that upon your death, your assets are given to the heirs that you specify. Without a will, your estate will be distributed according to state law.

The marketers of living trusts have done a good job of informing the public about the alleged evils of probate. Stories are legendary of will contests arising or of attorneys charging tens of thousands of dollars in legal fees to settle the simplest of estates. Probate in Texas, however, can be easy and inexpensive by providing for an independent administration within a "self-proved" will.

Probate is the process by which your financial affairs are wound up and your assets are distributed to your heirs. This administration will be required whether you die with or without a will, and your executor will be the person that oversees the process. As part of the probate administration, your executor will gather your assets, pay any of your creditors, determine your rightful beneficiaries or heirs, and distribute any remaining assets to the proper persons.

Clearly, the primary function of a will is to leave instructions on how to distribute your property after your death. A lesser known function of a will is to appoint the executor who will carry out your wishes. By appointing your executor, you have an opportunity to save your heirs significant amounts of money in legal fees.

In Texas, the executor can be authorized to conduct either a dependent or an independent administration. In a dependent administration, the Probate Court must supervise the administration of the estate. Under this supervision, each step of the probate process must be presented to the Probate Court for approval. This means that the probate attorney your executor hires may have to prepare several motions and make several trips to the courthouse, all costing the estate time and money.

In contrast, the executor in an independent administration is given wide latitude to administer the estate without obtaining court approval of each step of the process. In fact, in an independent administration, Texas law provides that no action shall be had in the courts in relation to the settlement of the estate other than 1) the probating and recording of the will, and 2) the filing of an inventory, appraisement, and list of claims of the estate. Think about it: after the offering up of the will and the filing of an inventory, it is possible that your executor (and his or her lawyer) will not have to make any more trips to the courthouse!

Because the powers granted to an independent executor are very broad, it is imperative that you have the highest level of confidence in the diligence and integrity of the executor you appoint. There have been cases where a poor choice for executor has led to disastrous results. Thus, an independent executor should be chosen carefully and should be someone in whom you have complete trust.

A second procedure that can significantly reduce the legal fees incurred by your estate is the use of a "self-proved" will. In a self-proved will, the testator and the witnesses sign the will. While doing so, the testator and witnesses sign a "self-proving affidavit"; which is attached or incorporated into the will. The affidavit is later used when the will is offered for probate, providing proof of the necessary execution requirements. This eliminates the need to locate the witnesses and will work even if the witnesses are deceased.

Before rushing out to buy a will kit that features a "personal representative" and an attached notarized affidavit, please realize that the language in many will kits does not substantially comply with the Texas requirements for independent administration or for a self-proved will.

Also, a will must also be executed with certain formalities in order to be considered valid under the Texas Estates Code. The instructions in the kits, if there are any, are not always clear. This results in the use of the wrong form or incorrect completion or execution of the document. This could force your beneficiaries to pay money to attorneys to litigate the correct meaning and validity of your will. This amount will easily surpass any amount you would have paid to have a will correctly drafted in the first place.

Willing Good: Goal-Driven Estate Planning

Your Will, as part of a comprehensive estate plan, is your last chance to do something good for your family. Hence the term, "Willing Good." You now know the advantages of having a Will. What if, however, you could go beyond the basics and draft a Will that helps you or your heirs achieve goals after you are gone? That's what goal-driven planning is about. Please visit our page on Goal-Driven Planning.