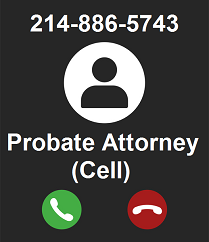

Probate: 469.708.6050

Wills & Guardianship: 214.227.6400

13355 Noel Rd., Ste. 1100

Dallas, Texas 75240

Special Needs Trusts

The Problem: how to give assets to your son or daughter with special needs without destroying his or her Medicaid and SSI eligibility

In Texas, Medicaid and SSI are reserved for those persons with limited assets. Furthermore, qualifying for Medicaid and/or SSI qualifies that person for a whole host of other programs including Community Living Assistance and Support Services (CLASS), Home and Community-based Services (HCS), and Day Activity and Health Services (DAHS), just to name a few. In general, an applicant must have less than $2,000 in "countable assets" in order to qualify for the programs. Parents wanting to leave property to their son or daughter on public assistance previously faced a dilemma: leave property to their son or daughter and destroy Medicaid/SSI eligibility, or disinherit their son or daughter entirely.

Alternatively, a person on public assistance may inadvertently come into property, either through the recovery of a personal injury lawsuit or an unplanned inheritance resulting from an intestate distribution. The result is the same, loss of Medicaid/SSI eligibility.

The Solution: a Special Needs Trust

A special needs trust, also referred to as a supplemental needs trust or "SNT", is a trust that holds property solely for the benefit of a disabled person referred to as the beneficiary. Since the assets in the trust are not readily available to the beneficiary, the assets in the trust are considered "non-countable" assets for Medicaid and SSI purposes. The trust therefore allows you to transfer property for your son's or daughter's benefit without destroying their eligibility for public assistance.

Establishing the Special Needs Trust

With the assistance of an attorney, establishing a special needs trust is easy. In order to determine what type of trust you need, you first need to determine the source of the assets to be placed into the trust. You also need to decide when to fund the trust. Here are some attributes of special needs trusts:

Source of Assets

Self-funded or first-party or D-4-A trusts. In this type of trust, the assets to be placed in the trust already belong to the beneficiary. The assets may have resulted from life-long savings, an inheritance that was not properly planned, or the proceeds of a lawsuit. Once the assets are placed into the trust, the beneficiary can continue to receive public assistance while still having assets in the trust. There is a downside to this type of trust: if there are any assets left in the trust upon the death of the beneficiary, they must be used to reimburse the state for any medical expenditures it has made for the benefit of the beneficiary.

Third-party trusts. In this type of trust, the assets to be placed in the trust belong to someone other than the beneficiary. Typically the assets are coming from a parent, grandparent, or sibling, but the assets can come from anyone. So in addition to parents, this type of trust is perfect for grandparents and siblings who want to leave part of their estates to their favorite grandchild, brother or sister. Furthermore there is no Medicaid pay-back requirement in this type of trust. The trust grantor may specify who receives the assets that are remaining in the trust upon the death of the beneficiary.

Timing

Inter-vivos trusts. This type of trust is established during the beneficiary's lifetime and the grantor's lifetime. Hence the term "inter-vivos" which means "between the living".

Testamentary trusts. This type of trust is established upon the death of the grantor. The trust is included as part of the grantor's last will and testament, hence the name testamentary trust.

The requirements for Special Needs Trusts

In Texas, there are no special statutory requirements for a special needs trust. In order to be considered a valid trust, a special needs trust need only meet the requirements of any other type of Texas trust. So when we speak of the requirements for a special needs trust, we are talking about the requirements to preserve Medicaid/SSI eligibility, not the requirements to be considered a valid trust.

Self-Funded Trust

The requirements for self-funded special needs trust are the most onerous. A self-funded special needs trust must meet the following requirements:

- the trust must be irrevocable;

- the trust must be established by a parent, grandparent, guardian or court;

- the beneficiary must be the only beneficiary under the trust;

- the beneficiary must be considered disabled under 42 U.S.C. Section 1382c(a)(3)(A), i.e. the beneficiary is unable to engage in any substantial gainful activity by reason of any medically determinable impairment which has lasted or will last at least twelve months;

- the beneficiary does not have access to the trust, i.e. the trustee cannot be compelled to make distribution for the support and maintenance of the beneficiary; and

- the assets of the beneficiary were used to form all or part of the corpus of the trust;

- the assets must be placed into the trust before the beneficiary turns 65 years;

- the state will receive all amounts remaining in the trust upon the death of the beneficiary up to an amount equal to the total medical assistance paid on behalf of the beneficiary.

Many of the federal requirements come from 42 United States Code § 1396p. In fact, the term "D-4-A" comes from the subsection that contains the law for self-settled trusts, 42 U.S.C. § 1396p(d)(4)(A). Title 1, Part 15, Chapter 358, Subchapter C, Division 2, Rule §358.336 of the Texas Administrative Code contains the state requirements.

Third-Party Trusts

The requirements for third-party special needs trust are less stringent. A third-party special needs trust must meet the following requirements:

- the trust must be irrevocable;

- the trust must be established by a parent, grandparent or any other person who wants to give assets to the beneficiary;

- the beneficiary must be the only beneficiary under the trust;

- the beneficiary must be considered disabled under 42 U.S.C. Section 1382c(a)(3)(A), i.e. the beneficiary is unable to engage in any substantial gainful activity by reason of any medically determinable impairment which has lasted or will last at least twelve months;

- the beneficiary does not have access to the trust, i.e. the trustee cannot be compelled to make distribution for the support and maintenance of the beneficiary;

- no assets of the beneficiary can be used to form all or part of the corpus of the trust;

- there is no age requirement - the assets can be placed into the trust at any time; and

- there is no payback requirement to the state.

So if there is no payback requirement to the state, where do the funds remaining in the trust go after the beneficiary's death? The Grantor gets to decide who receives the remaining funds. Therefore, a parent can designate their disabled son or daughter as the primary beneficiary, and their siblings as the remainder beneficiaries. Thus, it pays to plan.

Getting property into the Trust

Getting assets into a special needs trust can be very easy or very difficult, depending upon the amount of pre-planning done by the entire family.

The funding and management of a testamentary special needs trust is extremely easy. A testamentary trust is actually a subsection of your will that includes a trust. The gift section of your will typically leaves a gift to the trust. The will then spells out the terms of the trust. Thus, the trust is a "springing" trust in that it springs into existence upon your death. Before that happens, however, there is no trust and therefore no need to manage the trust. For the grantor, it could not be any easier.

The funding and management of an inter-vivos trust is slightly more difficult. An inter-vivos trust is established during your lifetime. Instead of being part of your will, the trust is its own separate and distinct legal document. Once the trust is executed, it must be funded with assets. The trust need only be funded before the beneficiary turns 65 so you can choose to wait before you or someone else decides to transfer assets into the trust. Only then will you have to start the administration of the trust.

The funding and management of a first-party special needs trust is the most difficult. If the beneficiary is already in possession of the assets, then a parent, grandparent, guardian, or court can create the trust and transfer the beneficiary's assets into the trust. The beneficiary may not create his or her own trust, even if he or she is otherwise legally competent. If the bank, finance company, or other person or entity in possession of the assets will not allow the transfer to occur, then a lawsuit must be filed in a court wherein the court orders that the assets be placed into the trust. Under this scenario, however, the beneficiary is in the position of trying to re-establish eligibility for benefits. This may result in the beneficiary going to the back of the line for benefits or even a permanent loss of benefits.

Conclusion

A family with special needs has a unique responsibility when it comes to estate planning. If a family member fails to execute a will, part of that family member's estate may go to his or her loved one with special needs. This seemingly beneficial event could have the disastrous effect of inadvertently destroying Medicaid eligibility. A carefully drafted last will and testament coupled with a special needs trust can allow property to pass to your son or daughter without destroying their Medicaid and SSI eligibility. Contact the Duran Firm today to start work on your will and special needs trust.